On 26 June 2025, President Bola Ahmed Tinubu signed the four (4) Tax Reform Bills into law. These laws include the Nigeria Tax Act (NTA), The Nigeria Tax Administration Act (NTAA), The Nigeria Revenue Service Act (NRSA) and The Joint Revenue Board Act (JRBA), collectively referred to as “the Acts”.

The Acts comprehensively overhaul the Nigerian tax system to drive economic growth, increase revenue generation, improve the business environment and enhance effective tax administration across the different levels of government.

Here are the top 20 changes to know about the Acts The Act provides that income tax will be imposed on the

- profits or gains of any company

(Including chargeable gains hitherto chargeable under the erstwhile Capital Gains Tax Act),

- income of any individual and

- income arising, accruing or due to a trustee or an estate.

Under the Act, a company can be charged to tax in its own name, principal officer, representative, receiver, liquidator or administrator.

1. Clarity in transactions liable to income tax

The NTA explicitly states that prizes, winnings, honoraria, grants, awards, profits or gains from transactions in digital or virtual assets are chargeable to tax. However, losses incurred from transactions in digital assets would only be deductible from the profits from digital assets business. The taxation of digital assets will pose some challenges, and the tax authorities need to rise to these challenges. One obvious challenge is how to correctly value digital assets for tax purposes given market volatilities. In addition, the National Revenue Service (NRS) may struggle to track digital asset transactions and enforce reporting requirements since these assets can be held in a manner that may make it difficult to identify the true owner. This is where international coordination will prove invaluable.

2. Broadening of the definition of interest

Interest is defined to include penal interest, foreign exchange difference arising in relation to securities, payment in relation to derivatives or similar payment.

3. Increased exemption threshold for small companies –

Small companies are now exempt from Companies Income Tax (CIT), Capital Gains Tax (CGT) and the newly introduced Development levy (see below). Small companies are defined as companies with annual gross turnovers of NGN100million (previously NGN25million) and below and total fixed assets not exceeding NGN250million.

4. Increased Capital Gains Tax (CGT) rate –

The NTA increases the Capital Gains Tax rate from 10% to 30% for companies. This effectively aligns the CGT and Companies Income Tax rate and reduces any tax arbitrage that could have been unduly enjoyed in the classification between chargeable gains and trading income. For individuals, capital gains will be taxed at the applicable income tax rate based on the progressive tax band of the individual.

5. CGT on Indirect transfer of shares –

The NTA introduces CGT on indirect transfers of shares in Nigerian companies so that where shares are disposed of in intermediary holding companies offshore, a Nigeria CGT is triggered (subject to treaty exemptions). Also, the tax exemption threshold for the sale of shares in Nigerian companies has been increased to NGN150million (from NGN 100 million) in any 12 consecutive months, provided that the gains do not exceed NGN10million.

6. Introduction of Development Levy –

Nigerian companies except small companies will pay a “Development Levy” at 4% of their assessable profits (i,e. tax profits before deducting tax depreciation and losses). The Development Levy consolidates the Tertiary Education Tax (TET), Information Technology Levy (IT), the National Agency for Science and Engineering Infrastructure (NASENI) levy and the Police Trust Fund (PTF) levy.

7. Minimum Effective Tax Rate (ETR) –

Nigerian companies who are members of a multinational group with aggregate group turnover of EUR750million and above or have an annual turnover of NGN50billion and above, will now be subject to a minimum effective tax rate (ETR) of 15% of their “Net Income”. Net Income is defined as profits before tax excluding franked investment income and unrealised gains or losses, except for life insurance companies where the definition of Net Income also excludes gross and investment income for policyholders. The minimum The Nigerian parent company of a multinational group will have to pay a top up tax where its subsidiaries have paid taxes below the minimum 15% ETR.

8. Controlled Foreign Company rules

The NTA imposes a tax on undistributed profits of foreign companies controlled by Nigerian companies, where it is considered that the foreign subsidiary could have distributed dividends without harming its business.

9. Taxable profits of non-residents

The NTA expands the scope of the activities of non-resident companies that are subject to tax in Nigeria. Notably, the NTA introduces “force of attraction” rules. Under these rules, certain activities carried out by a non-resident company or its related parties, can be taxed as part of the non resident company’s permanent establishment (PE) in Nigeria, even if those activities are not physically conducted through the PE. In addition, profits from Engineering, Procurement, and Construction contracts can be taxed in Nigeria, even if some of the activities are performed under separate contracts or outside Nigeria.

9. i. Taxation of Non-Resident Persons (NRPs)

In determining the total profits, only expenses incurred in producing the profits attributable to the permanent establishment in Nigeria will qualify for deduction. However, no deduction will be allowed in respect of royalty, fees, or similar payments in return for the use of patents or other rights. Where the total profits of a NRP cannot be ascertained, the NRS shall apply the applicable profit margin to the total income generated from Nigeria. However, the tax payable by any NRC will not be less than the tax withheld at source. If the NRC does not have any income liable to withholding tax, the tax payable shall not be less than 4% of the total income generated from Nigeria. The profit (based on earnings before interest and tax) shall be established from the published financial statements. However, where the financial statements are not available, the NRS shall determine the profit margin based on that of a comparable company.

10. Minimum Tax for Non-resident companies

Non-resident companies who have a taxable presence in Nigeria will now be subject to minimum tax based on the percentage of their earnings before interest and tax (EBIT) to the total income generated from Nigeria. In any case, tax payable by such companies cannot be less than the withholding tax (WHT) rate applicable to the income, or 4% of the income.

11. Restriction on the tax exemption status of free zone entities

Based on the publicly available version of the bills submitted for presidential assent, Free Zone companies will continue to enjoy full tax exemption on their exports, or output that go into goods or services eventually exported, or supplied to oil and gas companies. Proportionate taxes apply where more than 25% of the Free Zone company’s sales are made to the customs territory. From 1 January 2028, the full profits of Free Zone entities will be subject to tax if they make any sales to the customs territory.

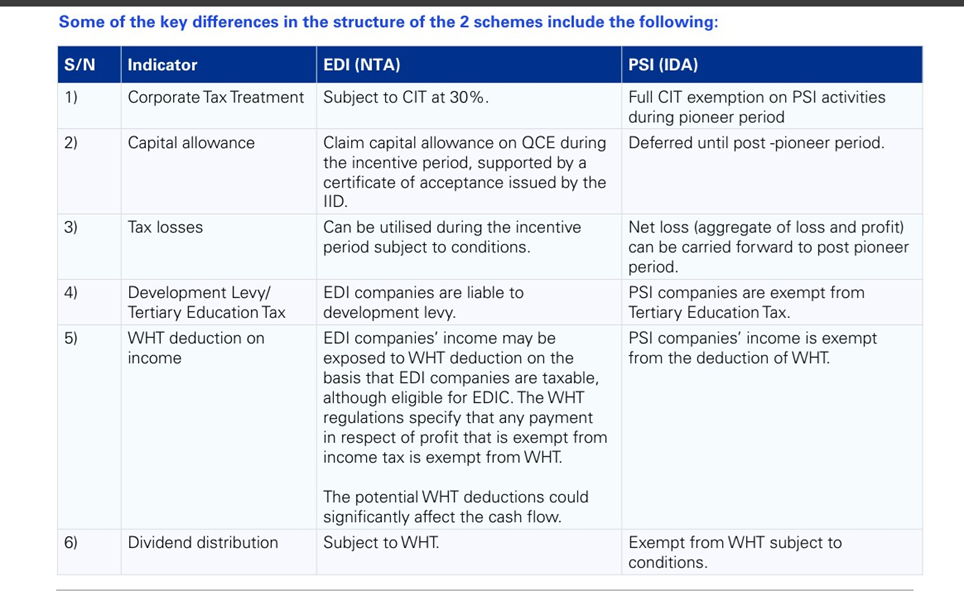

12. Introduction of Economic Development Incentive

The Acts replace the “pioneer” tax holiday incentive, with an “Economic Development Incentive” (or EDI). This incentive introduces a tax credit of 5% per annum for 5 years on qualifying capital expenditure purchased by eligible companies within 5 years effective from the production date. If a company has unused tax credits or qualifying capital expenses, it can carry them forward for another 5 years. Any credits still unused after this timeline will expire.

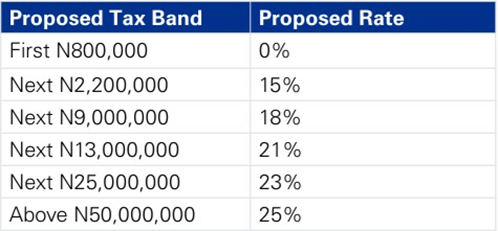

13. A more progressive Personal Income Tax (PIT) regime

The NTA changes the income brackets and applicable tax rates for each bracket. Individuals earning NGN800,000 or less per annum will now be exempt from tax on their income and gains, while higher income earners will be taxed at a higher rate up to 25%. The Act also increases the tax exemption threshold for compensation for loss of employment or injury from NGN10million to NGN50million

13.i. Rates of tax for individuals

Section 58 of the Act introduces a tax-exempt threshold of N800,000 and increases tax rates for high income earners. The new tax rates range from 0% to 25%. The Fourth Schedule of the Act, reproduced in the table below, shows the tax bands and rates:

The revised structure introduces a more progressive tax system by providing significant relief to low income earners and ensuring that higher income earners contribute a larger share of their income.

14. Resident and Non-Resident Individuals defined

PIT will apply to the worldwide income of a resident individual which is now clearly defined in the new Act. Prior to now there had been varied interpretations due to a lack of proper definition of “residence”. With the definition extending to individuals with substantial economic and immediate family ties in a year of assessment, the law widens the tax net. Employment income will now be taxed in Nigeria only if the individual is resident in Nigeria or performs duties in Nigeria without paying tax in their country of residence effective tax rule does not apply to Free Zone companies on their exports out of Nigeria, provided that such companies are not part of multinational groups.

15. Introduction of the Tax Ombuds office

The Acts introduce the Tax Ombuds office to liaise with the tax authorities on behalf of taxpayers, and serve as an independent arbiter to review and resolve complaints relating to taxes, levies, duties or similar regulatory charges.

16. Input VAT Recovery

The VAT rate of 7.5% has been retained. Nigeria now adopts globally recognised VAT principles that allow for the claim of input VAT on all purchases including services and fixed assets. Businesses can now recover input VAT provided that the input VAT is directly related to their supplies that are also subject to VAT.

17. VAT at zero rate on essential goods and services

The NTA expands the list of zero-rated items to include essential goods and services such as basic food items, medical and pharmaceutical products, educational books and materials, electricity generation and transmission services, medical equipment and services, tuition fees, exports (excluding oil and gas exports) etc. The impact of this is that businesses selling these goods and services can recover their VAT costs, despite the zero rate which was previously not possible by law.

18. VAT fiscalisation rules

Nigeria has now codified VAT fiscalisation rules and mandatory e-invoicing for businesses operating in the country. This sets Nigeria apart as an early adopter of e-invoicing in Africa. Companies in Nigeria are now mandated to implement the fiscalisation system deployed by the tax authority for the collection of VAT.

19. Update to the VAT sharing formula

The Acts reduce the Federal Government’s share of VAT from 15% to 10%, while increasing the allocations of states and Local Government Areas to 55% and 35%, respectively. The VAT revenue assigned to states and local governments is further allocated as follows: 50% divided equally, 20% based on population, and 30% based on place of consumption.

20. Increased penalties for non-compliance

There has been a significant increase in non-compliance penalties and the introduction of new penalties. Some of the updates include increase in the penalty for failure to file returns to NGN100,000 in the first month, and NGN50,000 for every month the failure continues, introduction of new penalties such as penalty of NGN5million for awarding contracts to individuals or entities that are not registered for tax, penalties for failure to grant access for deployment of technology, inducing a tax officer etc.

21. Disclosure of tax planning arrangements

The NTAA requires companies to voluntarily and proactively notify the tax authorities of tax planning transactions or schemes which can provide a tax advantage. The term “tax advantage” refers broadly to any situation where a person or entity benefits from a favorable tax outcome. This includes obtaining new or increased tax reliefs, receiving or increasing tax repayments, reducing or avoiding tax charges or assessments, deferring tax payments or accelerating tax repayments, and avoiding obligations to deduct or account for tax. Essentially, it covers any arrangement or action that results in a more beneficial tax position than would otherwise occur.

22. Introduction of rent relief

The NTA eliminates the Consolidated Relief Allowance (CRA) and introduces a rent relief under Section 30(vi), which is 20% of annual rent paid, subject to a maximum of ₦500,000, whichever is lower. However, to claim this relief, declarations must be made regarding the actual rent paid, and the tax authority has the right to request additional relevant information. The takeaway from this is that individuals that live in their own accommodation cannot claim such relief. This begs the question of why the CRA has not been retained.

23. Chargeable gains and assets

According to Section 34 of the NTA, chargeable assets include all types of property, including shares, options, rights, debts, digital assets, intangible property, and foreign currencies. However, gains from selling shares in Nigerian companies are not taxable if:

- the sale proceeds are less than ₦150 million, and the chargeable gain does not exceed ₦10

million within 12 consecutive months

- the shares are transferred between approved parties in a regulated Securities Lending

Transaction.

- the proceeds from disposal are reinvested within the same assessment year in shares of

Nigerian companies. However, the portion not reinvested will be taxed.

24. Stamp duty on loan capital

Section 136 provides that the loan capital of any company will be liable to ad valorem tax. The NTA has defined loan capital to include debenture stock, other stock or funded debt whatever name known, or any debt raised by any corporation, company or body of persons formed or established in Nigeria but excluding an overdraft, loan obtained for a period not exceeding 12 months. The key takeaway from this is that any loan with a duration of more than 12 months will now be subject to stamp duty.

25. FIRS renamed the Nigeria Revenue Service and SIRS become autonomous

The Federal Inland Revenue Service (FIRS) has now been renamed the Nigeria Revenue Service (NRS) to reflect its responsibilities as the body to assess, collect and account for revenue due to federation. The Acts also provide that State Internal Revenue Services will be autonomous in the running of their affairs. The Law also provides the framework for joint audits and for NRS to, upon request, support State and Local governments to collect and administer taxes.

26. Tax incentives

The Act introduces several tax incentives, such as:

- Income generated by companies engaged in agricultural businesses, including crop production, livestock, aquaculture, forestry, dairy, cocoa processing and manufacturing of animal feeds will be exempt from income tax for the first five (5) years from commencement of business.

- A company will be entitled to an additional deduction of 50% in the relevant years of assessment in respect of costs incurred in any 2 calendar years from 2023 to 2025 with respect to the following:

- wage awards, salary increases, transportation allowance or transport subsidy granted to a low-income worker that bring the gross remuneration of such worker to an amount not exceeding ₦100,000. However, any award or salary increase to any worker earning above ₦100,000 shall not qualify. •

- salaries of any new employees that constitute a net increase in the average number of new employees hired in 2023 and 2024 calendar years over and above the average net employment in the three (3) preceding years, provided that such new employees are not involuntarily disengaged within a period of 3 years post-employment. Net employment is defined as the total number of persons employed less the total number of persons disengaged during the calendar year, irrespective of whether the disengagement is voluntary or not.

27. Other incentives include

- Deduction for research and development: The deduction to be allowed under Section 164 of the NTA has now been adjusted to 5% of a company’s turnover for the year. This represents a significant deviation from the provision under CITA, which allowed a deduction of 10% of total profits. The implication is that companies now have a broader base of 5% of turnover, as opposed to total profits, from which they can commit funds to research and development activities. The NTA also provides that where a company that has enjoyed this deduction transfers or sells the outcome of the research and development to another person, the proceeds from the sale or transfer shall be taxable.

- Economic Development Incentive (EDI):

The NTA repeals the Industrial Development Act and replaces the Pioneer Status Incentive (PSI) with the EDI under Part II of Chapter 8 of the NTA. The scheme introduces a targeted incentive regime aimed at stimulating capital investment in defined priority sectors. To qualify for this incentive, the Qualifying Capital Expenditure (QCE) to be incurred by the company on or before production day